Reforms in a few countries drive a decline in average OECD labour taxes | Hellenic Shipping News Worldwide

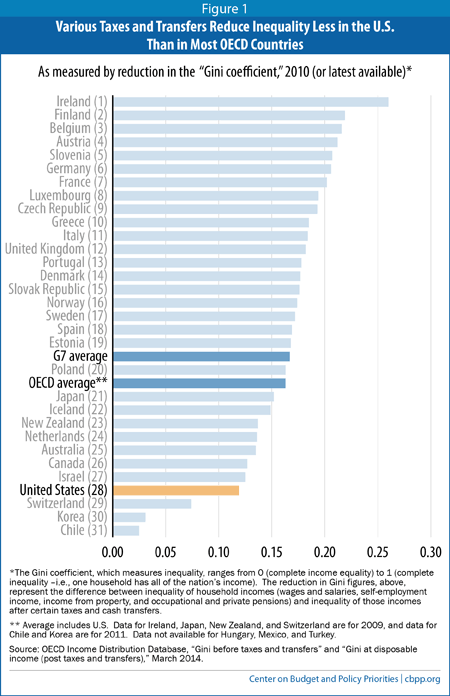

What Do OECD Data Really Show About U.S. Taxes and Reducing Inequality? | Center on Budget and Policy Priorities

OECD - Average yearly wages in OECD countries range from USD 15.3K in Mexico to USD 62.6K in Luxembourg. How does your country compare? Explore the data ➡️ http://bit.ly/2ozbiNT | Facebook